excise tax rate nc

Excise tax is customarily paid by the. This title insurance calculator will also.

North Carolina Cigar Tax Cap Signed Into Law Halfwheel

Appointments are recommended and walk-ins.

. 2016 Alcoholic Beverages Tax Tehcnical Bulletin. On top of state excise taxes on alcohol and. Excise Tax on Conveyances Article 8E of Chapter 105 of the North Carolina General Statutes General Information Excise Tax is a state tax computed at the rate of 100 on each.

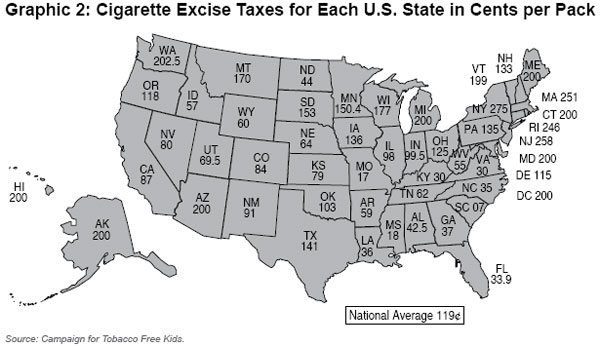

Through June 30 2022 the state excise tax on cigarettes ranges from 0170 per pack in Missouri to 4350 per pack in Connecticut and New York. North Carolina County Tax Offices. Customarily called excise tax or revenue stamps.

North Carolinas general sales tax of 475 also applies to the purchase of beer. When ownership in North Carolina real estate is transferred an excise tax of 1 per 500 is levied on the value of the property. The State of North Carolina charges an excise tax on home sales of 200 per 100000 of the sales price.

Imposition of excise tax. 2013 nc tax expenditure database. The tax rate is one dollar.

In North Carolina beer vendors are responsible for paying a state. Imposition of excise tax. The standard North Carolina income tax rate is 525.

2016 Privilege License Tax Technical Bulletin. For example a 600 transfer tax would be imposed. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule.

The federal tax remains at 1010. Exemptions from Highway-Use Tax. The NC use tax only applies to certain purchases.

North Carolina applies a 005milliliter tax. The state sales tax rate in North Carolina for tax year 2015 was 475 percent. The State of North Carolina charges an excise tax on home sales of 200 per 100000 of the sales price.

The North Carolina use tax is a special excise tax assessed on property purchased for use in North. Excise TaxRevenue Stamps. You may want to think twice about your gas mileage if youre a North Carolina driver.

In North Carolina other tobacco products are subject to a state excise tax of 1280 wholesale price as well as federal excise taxes listed below. A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. 14 hours agoIn North Carolina penalties on payroll and excise tax deposits due on or after September 28 2022 and before October 13 2022 will be abated as long as the deposits are.

Easily calculate the North Carolina title insurance rates and North Carolina property transfer tax. The tax rate is one dollar. The table below summarizes state sales tax rates for North Carolina and neighboring states in 2015.

2016 Piped Natural Gas Tax Technical Bulletin. Vehicle Property Taxes. Excise TaxRevenue Stamps.

A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. Back to top Contact NCDMV Customer Service 919 715-7000. Excise tax is customarily paid by the.

North Carolina Beer Tax - 062 gallon. 2022 North Carolina state use tax.

State Income Tax Rates Highest Lowest 2021 Changes

Alcohol Excise Taxes Current Law And Economic Analysis Everycrsreport Com

What Is The Gas Tax Rate Per Gallon In Your State Itep

How High Are Spirits Excise Taxes In Your State

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Tennessee Alcohol Taxes Liquor Wine And Beer Taxes For 2022

North Carolina Excise Taxes Gasoline Cigarette And Alcohol Taxes For 2022

State Sales Tax Rates Sales Tax Institute

Real Federal Cigarette Tax Rates And State Cigarette Tax Rates Download Scientific Diagram

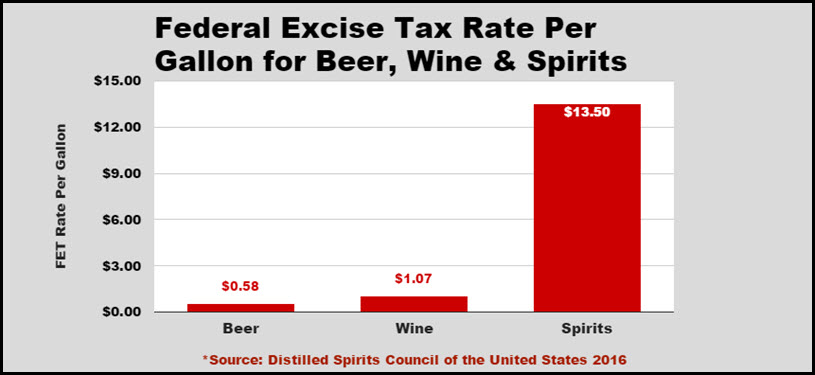

Part 1 The Distilled Spirits Federal Excise Tax Rate Is 1162 And 2228 Higher Than Wine And Beer Distillery Trail

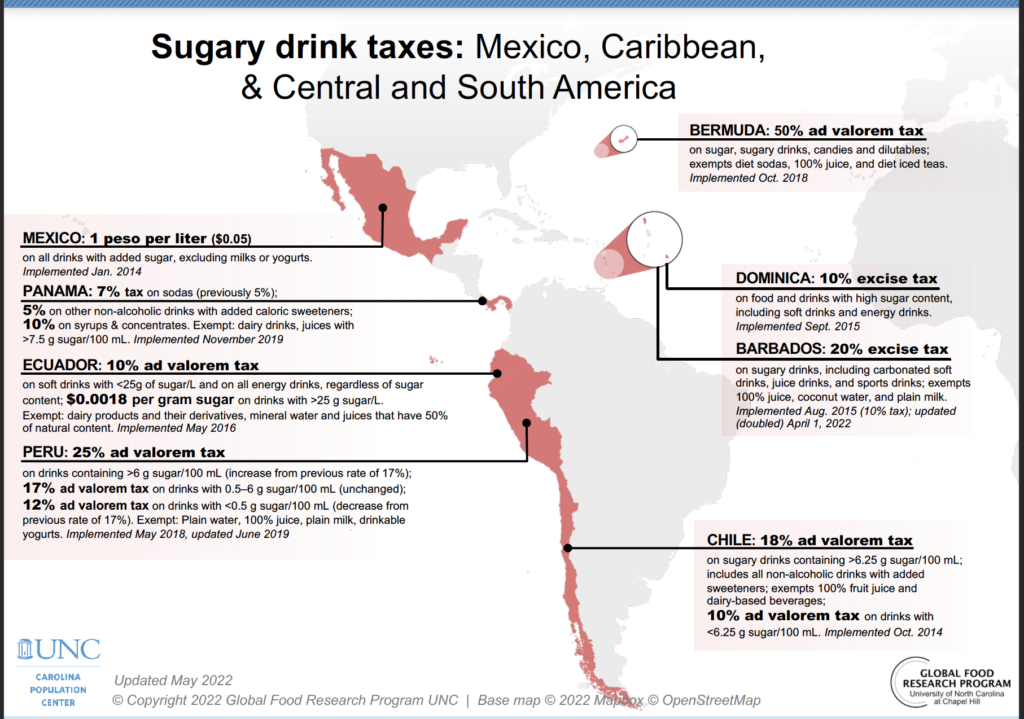

Making It Count The Next Battle Over Nigeria S Sugary Drinks Tax Health Policy Watch

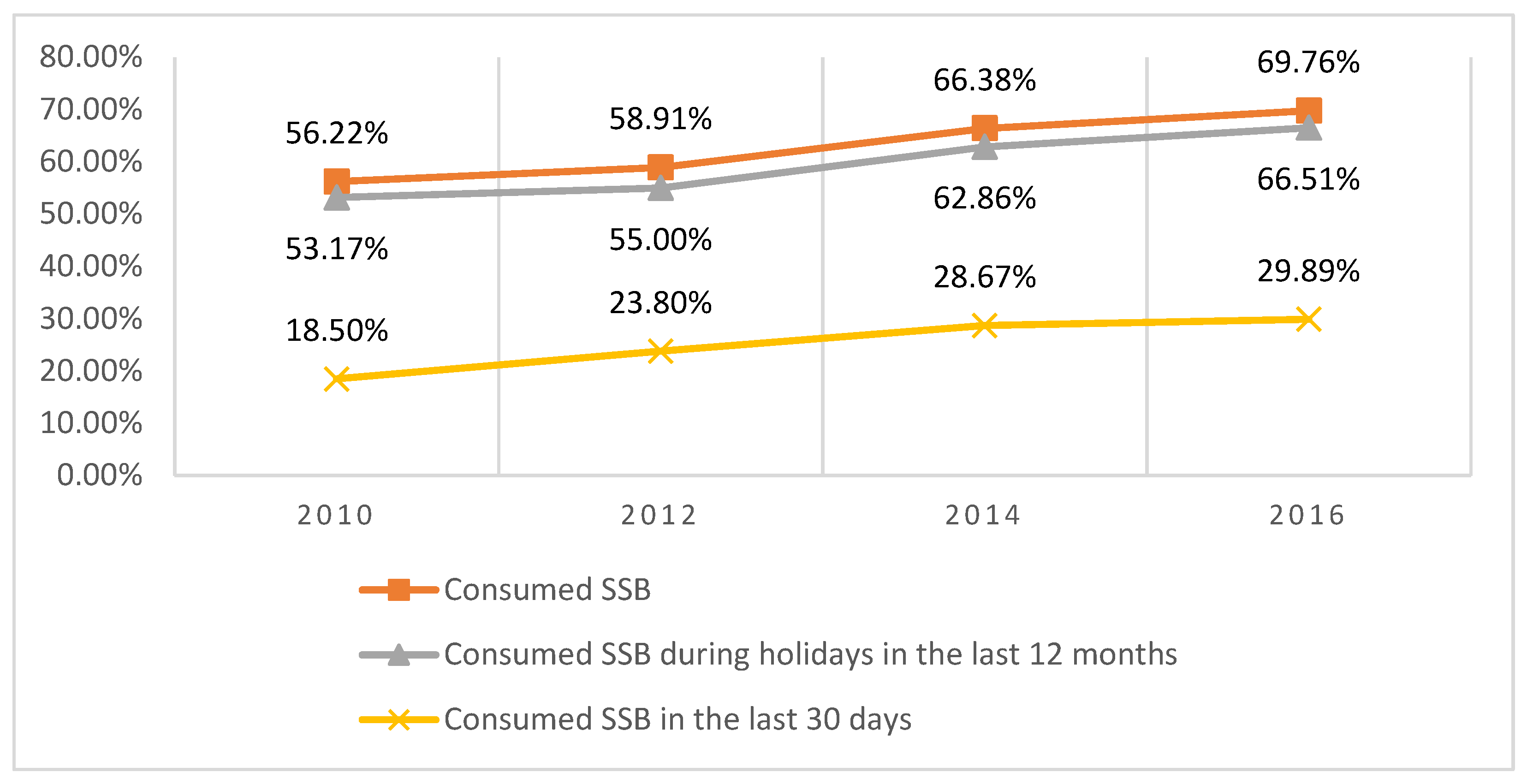

Sustainability Free Full Text Impacts Of Excise Taxation On Non Alcoholic Beverage Consumption In Vietnam Html

North Carolina Cigarette And Tobacco Taxes For 2022

Wine Tax By State Easy To Read Wine Excise Tax Rates Map

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

States With The Highest Lowest Tax Rates

How To Calculate Excise Tax In Nc

U S Cigarette Taxes Cigarette Taxes And Smuggling Mackinac Center

North Carolina Excise Taxes Gasoline Cigarette And Alcohol Taxes For 2022